When price is discussed 9 times out of 10 it’s regarding the fall from peaks, and not the long term upward trend.

Not everyone is blind to these changes with a number jurisdictions led by the Isle of Man clamouring to be Bitcoin friendly, on the flip side of the fiat coin it comes as no surprise that for years it’s been so difficult to conduct Bitcoin business with mainstream banks in the United Kingdom (many think London is the financial fraud capital of the world) exchanges like Intersango came and went due to the banking sector shutting them down, what we’re left with in the UK now is ‘exchanges’ that are glorified brokers, and on top of that some banks shutting down accounts at will if you have the ‘audacity’ to use them, you can read a worldwide list here.

Trade & Investment evolution.

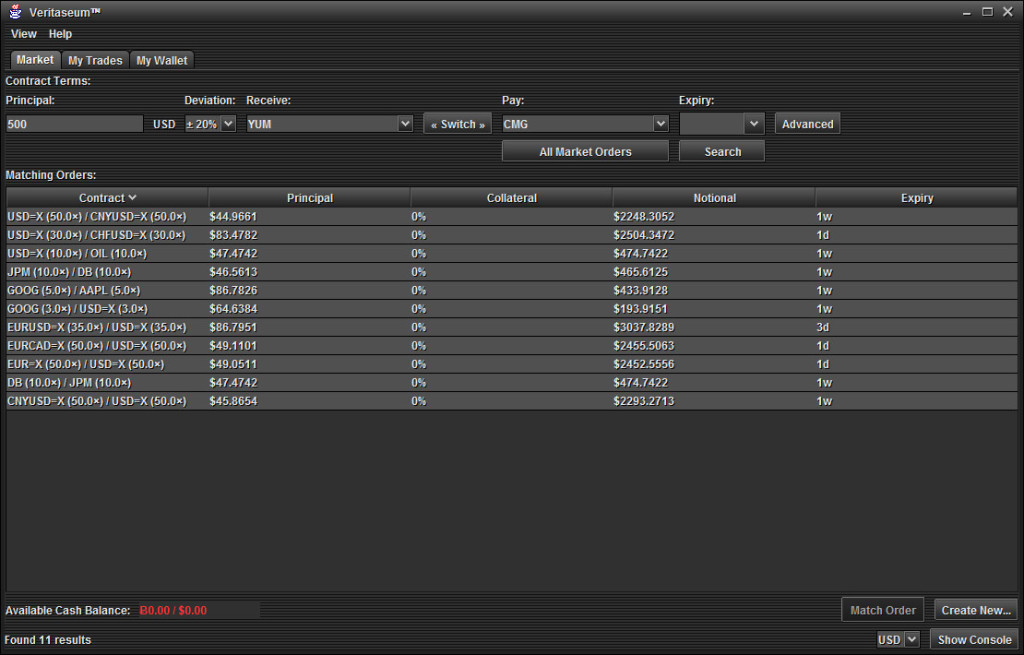

Let’s start with the first major evolution already in play, the stock market, you may baulk but as I said at the beginning of the article these things are already happening. Reggie Middletons’ Veritaseum completely disrupts and dis-intermediates traditional market tools allowing anyone to use his software to trade on a staggering number of indexes and commodities, this is software you can go and download right now, better still a web driven version is in the works.

Whilst the default view is the Dollar make no mistake BitCoin is the backbone, you can trade pretty much anything against anything with Veritaseum.

The potential of this tool is outrageous, it offers up to 10,000x leverage on over 45,000 tickers whilst using the Bitcoin network. Many won’t have heard of Veritaseum before and with good reason, software like this is a complete tankbuster bankbuster, so it’s no surprise the media aren’t crowing about it, it’s all a matter of time though until the cat comes leaping out of the bag on a grand scale.

Traditional methods of investment are also being revamped using Bitcoin technology, Bank to the future are already allowing investment on a wide variety of pitches using Bitcoin (and traditional currency) most impressive are the daily Bitcoin dividend payouts, the cost effective nature allowing dividend payouts on a much more regular basis than traditional models.

Moving money & wallet diversity.

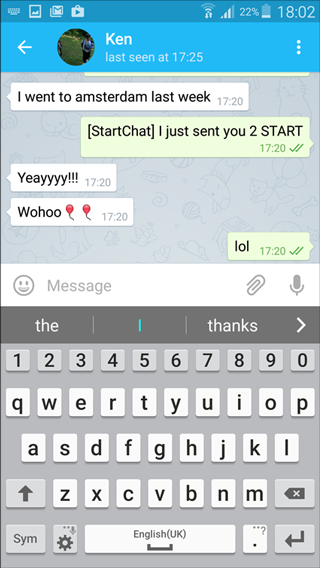

As BitCoin evolves so do the methods for holding them, a rapidly evolving number of products and options exist, cold storage by storing your Bitcoin offline, specific hardware vaults like Trezor, paper wallets, brain wallets, as well as a host of new regular wallets being released, regular wallets all have ways of sending Bitcoin of course, but none make it as simple as StartChat…

StartChat (available to download from the Android store) has baked in familiarity, it’s an encrypted decentralised chat client with integrated Bitcoin and StartCOIN send and receive features, the simplicity is the selling point and highlights just how quick and simple it can be to send currency person to person.

Content and services micro-payment evolution.

Lack of ease and fees are a burden for small transactions, this is where Bitcoin can make a big difference for transactions via the web. A tip jar becomes less appealing if you need to sign up and sign in to external services (you can just publish a Bitcoin address via text or QR code) The same goes for small transactions, this is where gourl comes in, it’s a powerful plugin for many of the biggest site/blogs such as wordpress, plus the open source nature means if you don’t like something about it, you’re free to make any modifications you want.

Have something you want to sell or monetise and want to give it a try? here’s a guide they put together allowing you to open your own webshop in 10 minutes https://bitcointalk.org/index.php?topic=1043437.20

So what about legacy banking?

No it’s not time for this yet… (Image credit Mike Poresky https://www.flickr.com/photos/mikeporesky/5106441340)

So does this all signify the end of banking? Probably not, as we know it? Maybe, there will always be a need for honest financial services.

Many write of a future without banks, whilst this is possible some kind of financial service will remain, we see banks scrambling to create their private blockchains, why? Because if they don’t own the blockchain they lift right out of the equation, we’ve seen this dis-intermediation in so many other sectors ironically often catalysed by the finance industry, is it possible to replace the whole sector with a combination of smart contracts, peer to peer lending and future technology? Probably.

Bitpay is an interesting case, and probably the closest comparison to a traditional bank, in theory you don’t have to use them to handle your money, they charge a fee, but they offer peace of mind and convenience, if they messed up or you didn’t agree with their business practise you’re free to go elsewhere, this forces the onus on Bitpay or indeed any future Bitcoin financial services to perform for you.

When you think about it this is how things should work in legacy systems, I believe we will see more of this competitiveness in the Bitcoin sector, with the freedom to do it yourself the message is quite clear, if you’re going to provide a service and charge for it you better be worth it!

Bitcoin services already well ahead in the race to zero.

![By KRoock74 (Own work) [CC BY-SA 3.0 (http://creativecommons.org/licenses/by-sa/3.0)], via Wikimedia Commons](https://backbit.co.uk/wp-content/uploads/2015/11/Toll_booths_in_the_UK.jpg)

By KRoock74 (Own work) [CC BY-SA 3.0 (http://creativecommons.org/licenses/by-sa/3.0)], via Wikimedia Commons

Many people dismiss Bitcoins chances in the medium to long-term, if it’s cheaper to use than everything else then it has a good chance of success, whilst over in the legacy world we have guaranteed loss now ZIRP and NIRP take hold of legacy systems globally, it’s entirely possible that despite volatility Bitcoin could offer a better store of value than traditional fiat, essentially fiat is engineering its own fate with the push into negative interest rates. When your savings are wiped out yet certain businesses and people are being paid to borrow money (this is already happening) how long will it take for people to wake up from this nightmare?

The outlook for Bitcoin services is pretty clear, unless you’re offering a genuine service worth paying for you’re going to be dis-intermediated by something that does the same for free. When I envisaged Backbit (see the rest of the site) I quickly realised there’s simply no point in trying to charge for it as it’s inevitable it will be provided free, and the short term potential profit is damaging to the ecosystem in the medium/long-term.

13F2GqpMLzHmisKTRALxtimQSmUdoUJakL